Unlock Your Future: The Ultimate Guide to Turbocharging Your 401(k) and IRA

Let’s face it: the world of retirement planning can feel overwhelming. But what if you could take control and build a truly secure future? This isn’t just about saving money; it’s about building a foundation for the life you’ve always dreamed of. This guide will show you how to turn your 401(k) and IRA into powerful wealth-building machines.

The Power Duo: Your 401(k) and IRA Explained

image from: gemini.google.com

First, let’s get acquainted with the two superheroes of retirement savings. They work best as a team.

- Your 401(k): Your Company’s Golden Ticket Think of your 401(k) as a special investment fund that comes with a priceless bonus: your company’s generosity. You put money in before taxes, and your employer often adds a contribution of their own—it’s free money you absolutely can’t afford to miss. This is your first and most important step toward financial freedom.

- Your IRA: Your Personal Wealth Engine An Individual Retirement Arrangement (IRA) is your personal account, giving you full control over your investments. The magic here is in the tax treatment, and you have two fantastic options:

- The Traditional IRA offers a tax break today, making it a great choice if you expect to be in a lower tax bracket during retirement.

- The Roth IRA is a powerhouse. You invest money you’ve already paid taxes on, and in return, every penny you pull out in retirement—all the growth, all the gains—is completely tax-free. This is a cornerstone of smart financial planning for long-term wealth management.

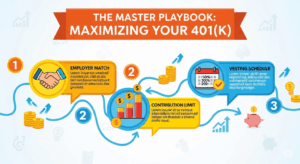

The Master Playbook: Maximizing Your 401(k)

image from: gemini.google.com

Your 401(k) is where you can see immediate results. Follow this game plan to get ahead:

- Don’t Leave Money on the Table: This is the most crucial rule. Always contribute at least enough to get your full company match. It’s an instant, guaranteed return on your investment.

- Go for the Gold: If your finances allow, challenge yourself to hit the annual contribution limit. Every dollar you put in now has decades to grow through the power of compounding.

- Know Your Rules: Check your plan’s vesting schedule. This is the timeframe you need to work at your company before the employer’s contributions become fully yours. It’s a key detail to know.

Your IRA Strategy: Traditional vs. Roth

The choice between these two accounts depends on your financial outlook.

- Choose a Roth if: You’re in your early career or expect your income to grow. Locking in tax-free income in retirement is a strategic move that pays off handsomely over time.

- Choose a Traditional if: Your current tax rate is higher than you anticipate it will be in retirement. The tax deduction now can feel like a great benefit, boosting your take-home pay.

Level Up Your Retirement Game

Think you’ve maxed out your options? Think again. For those who want to go the extra mile, these strategies can make a huge difference.

- The Catch-Up Contribution: If you’re 50 or older, you get a special boost. The IRS allows you to contribute an extra amount each year, giving you the chance to fast-track your savings.

- The Power of Compounding: Remember, your money is working for you 24/7. The sooner you start, the more your small contributions can grow into a massive nest egg. Don’t underestimate the long-term magic of time.

By mastering these strategies, you’re not just saving; you’re actively building the future you want. Start today, and let your money do the hard work for you.